A stock market is typically assessed according to its size, the quality of its listed companies, and the members of its trading community. Liquidity is another metric, as high levels of trading activity suggest a robust market where traders can buy and sell securities in large quantities without moving the price.

“Liquidity is an important indicator of a market’s sophistication,” said Ding Chen, Board Member of the Financial Services Development Council, and Chief Executive Officer, CSOP Asset Management. “There is a lot of research to show that markets with high levels of liquidity trade at a premium.”

She was speaking as part of a panel discussing the FSDC’s latest research report Observations on Market Liquidity Enhancement1, which explores ways that Hong Kong can boost its liquidity profile. If this can be achieved, it will be felt by a range of market participants.

“For investors, a more liquid market generates lower costs, increased efficiency, and most importantly, it improves price discovery,” said King Au, Executive Director, FSDC.

The Stock Exchange of Hong Kong is the consistently one of the world’s leading capital raising venues, regularly hosting record breaking IPOs that attract global investors to its primary market. But when it comes to secondary market trading, there is room for improvement.

Analysing liquidity profiles

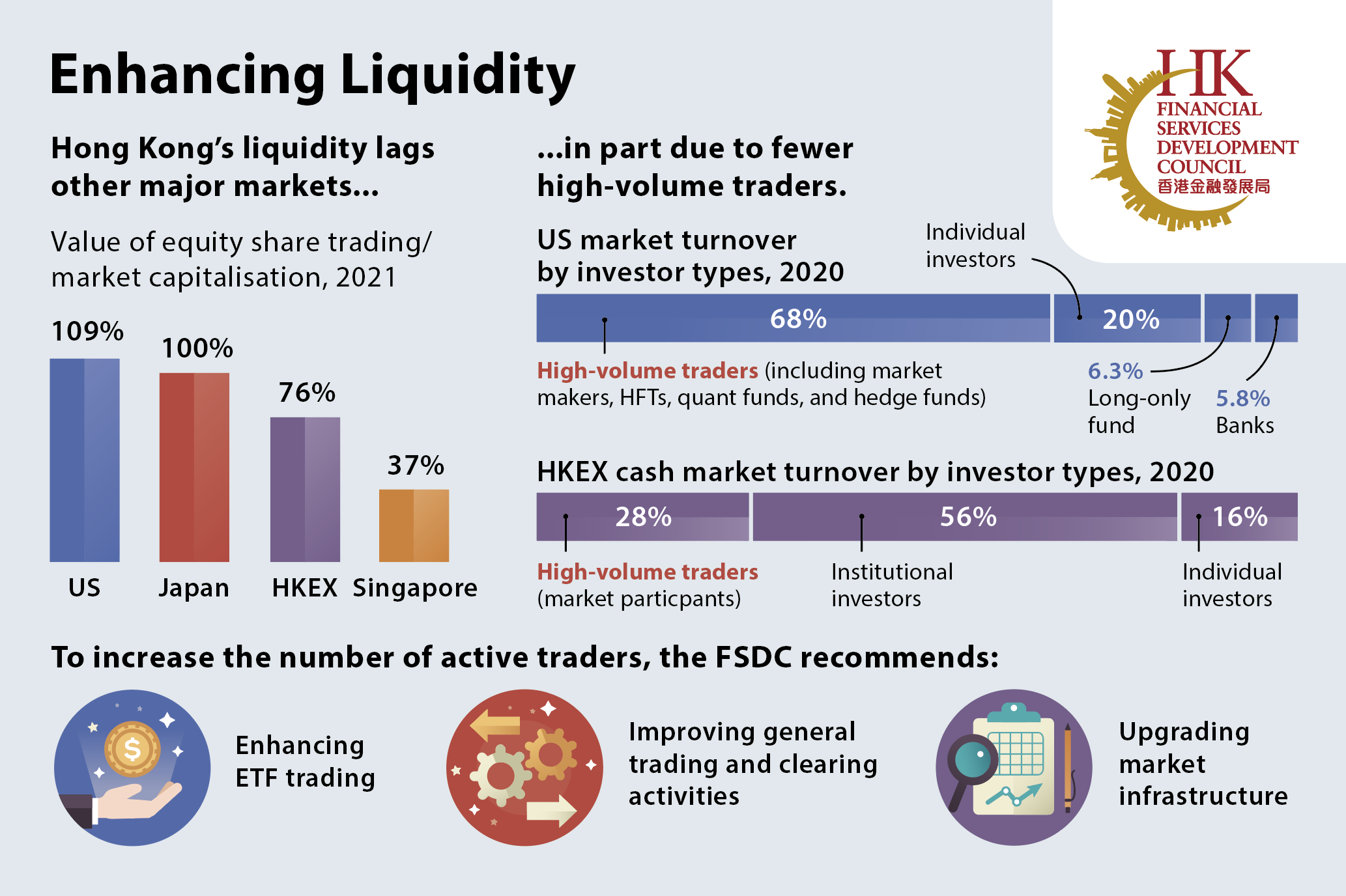

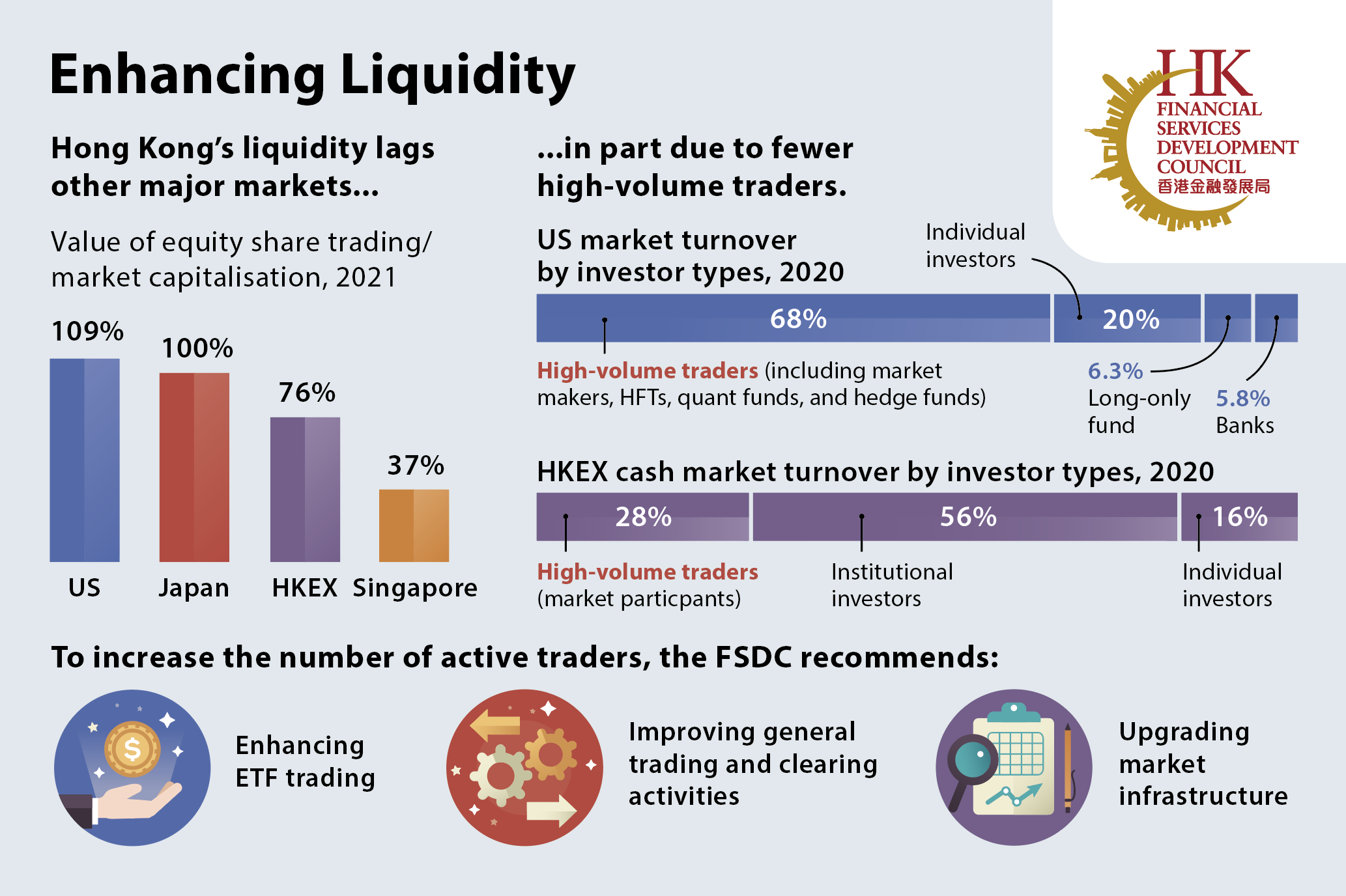

Market liquidity can be measured by turnover liquidity – the value traded relative to the overall market capitalisation. By this measure, Hong Kong scores 76.4%. This is significantly higher than in 2019, but lagging the US, where the Nasdaq and New York Stock Exchange combined have a turnover velocity of 109%.

What explains the gap between Hong Kong and the US markets? The answer can be found in the different kinds of investors active in the two markets. In Hong Kong, institutional investors dominate the cash market, accounting for 56.4% of turnover in 2020. These large institutions are less active traders than market makers, high-frequency traders (HFTs), and quantitative funds, which account for 28.1% of the city’s turnover.

In the US, it is a very different picture, with high-volume traders taking the lion’s share of trading. Market makers, HFTs, hedge funds, quantitative funds account for 67.9% of turnover.

Another key difference is prevalence of exchange traded funds (ETFs) in the US, which accounted for approximately 25% of total US stock trading in 2021, compared with just 4% in Hong Kong. ETFs generate liquidity as market makers are required to constantly trade the underlying securities when they create or redeem a unit of the fund or undertake rebalancing to reflect a change in the index.

A strategy for more active and efficient trading

There is no single measure that on its own will lead to a more liquid market. Instead, the FSDC makes a series of recommendations that fall under three broad categories: enhancing ETF trading activities, improving general trading and clearing activities, and upgrading infrastructure. Taken together, they form a holistic strategy to increase liquidity.

“Liquidity attracts liquidity,” said Thomas Fang, Head of China Global Markets, UBS. “Executable recommendations should focus on the overall ecosystem, such as market infrastructure and the cost base.”

A consistent theme throughout the report is reducing transactional costs and adding efficiency to ETF trading activities so that market makers can better perform their function as liquidity providers. For example, Hong Kong Exchanges and Clearing (HKEX) could introduce a new spread table with smaller minimum prices movements for Hong Kong-listed stocks to trade at different price ranges. This has the potential to reduce the trading costs for market makers when they offer pricing for investors, while enhancing flexibility and price efficiency for traders when they encounter unexpected market conditions.

Another area where improvements can be made is in market infrastructure. A trading system that uses advanced technology will facilitate the growing demands of market participants and keep Hong Kong competitive when compared with other major global exchanges. Highly active traders, such as market makers, will be key beneficiaries of any upgrades.

“The rise of market marking-driven liquidity has gone hand in hand with the progression and evolution of electronic trading,” said Jonathan Finney, Managing Director, APAC Business Development, Citadel Securities.

To realise its digital potential, HKEX could introduce a self-matching prevention mechanism. This would stop traders that have large volumes of trading instructions from matching buy and sell orders with themselves, thus avoiding unintended self-trading. Many exchanges in both developed and emerging markets have self-prevention mechanisms in place, reducing unintentional costs to traders. Introducing such a mechanism in Hong Kong would put the city in line with its peers by allowing traders to conduct a wider range of strategies.

Towards a vibrant secondary market

The most commonly cited strength of Hong Kong’s stock exchange is its primary market, which makes the city a world-leading place for corporates to raise capital. At the FSDC, we believe that a more liquid secondary market would complement and enhance the stock market’s role as an international IPO hub, by attracting more issuers and smoothing the trading process for investors. We hope that our recommendations will help realise a more vibrant secondary market.

1 FSDC